Scorelive

INTRODUCTION

The word Scorelive may sound simple, but it represents something much bigger. In today’s digital world, scores influence entertainment, money, education, and even online identity. Millions of people search for live score updates every day. At the same time, millions of others ask questions like what is my credit score, what is a good SAT score, or how does Snap score work.

This article brings everything together in one place. Instead of jumping between pages, apps, and confusing explanations, you’ll find a complete, deeply researched guide here. Every score discussed in this article affects real-life decisions. Some change every second. Others shape your financial future for years.

By the end of this guide, you will clearly understand how Scorelive connects sports scores, credit scores, academic scores, and digital scores and how to use that information correctly.

Your Global Scoring Resource |

What Does Scorelive Really Mean?

Scorelive reflects how people search for fast, reliable score updates. Search data shows that the word “score” appears in hundreds of millions of monthly searches worldwide. These searches fall into four main categories: sports, finance, education, and digital platforms.

Sports fans search for things like phillies score, dodgers score, yankees score, or nba score. Financial users search for credit score, what is a good credit score, or how to improve credit score. Students ask what is a good SAT score or what is a good PSAT score. Social media users ask how does Snap score work.

Because the same word is used everywhere, results often overlap. Scorelive becomes a bridge keyword that connects all these needs. Understanding the context behind each score helps you avoid misinformation and find accurate answers faster.

Scorelive and Live Sports Scores Explained

Sports scores are the most time-sensitive type of score. A live score can change every few seconds, and accuracy matters. During major events like the Super Bowl score or Superbowl score, millions of users refresh scores simultaneously.

Popular searches include:

- mets score

- cubs score

- brewers score

- braves score

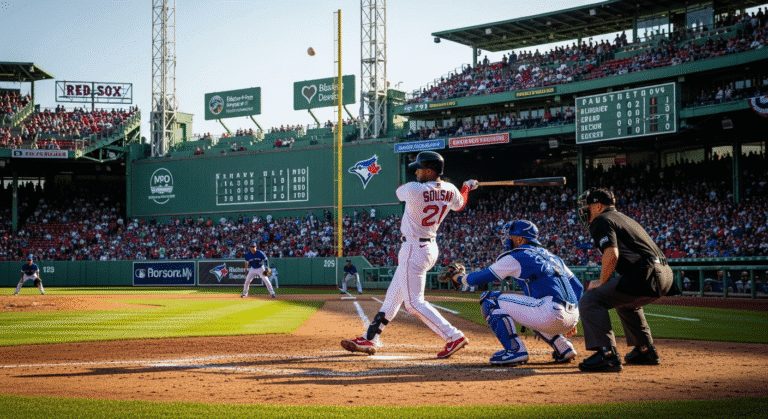

- red sox score

- astros score

- yankees score

- dodgers score

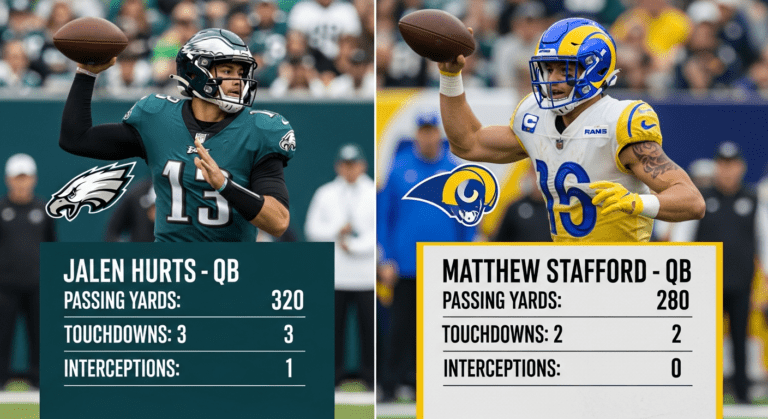

For football fans, common searches include nfl score, eagles score, chiefs score, bills score, lions score, and vikings score. Search engines prioritize freshness, so trusted platforms update scores every few seconds using official league data feeds.

A key mistake many users make is clicking outdated pages. Always look for timestamps, inning or quarter breakdowns, and live commentary. Reliable Scorelive results always show real-time updates, not just final scores.

Why Live Sports Scores Sometimes Appear Incorrect

Live score confusion usually comes from timing issues, not errors. Time zones, delayed broadcasts, postponed games, and preseason matches often cause misunderstandings. For example, a user searching what’s the score of the eagles game might see yesterday’s result if the new game has not started yet.

Another issue is duplicate team names across leagues or seasons. Adding “today” or the league name improves accuracy. For example, “nba score today” or “nfl score week 7” helps narrow results.

Scorelive works best when paired with clear intent.

What Is a Credit Score?

A credit score is a numerical representation of how responsibly you manage borrowed money. It is calculated using payment history, credit usage, account age, and recent activity. When people ask what is a credit score, they are really asking how lenders judge financial risk.

Credit scores typically range upward from low risk to high reliability. Higher scores indicate a stronger history of responsible borrowing. Lower scores suggest missed payments or high debt usage.

Your credit score directly affects loan approvals, interest rates, rental applications, and even insurance pricing in some cases.

What Is a FICO Score? (Market Dominance Explained)

When users ask what is a FICO score, they’re asking about the most widely used scoring model.

FICO Score Statistics

- Used by over 90% of top U.S. lenders

- Updated across multiple versions depending on loan type

- Evaluates 5 core factors: payment history, usage, length, mix, new credit

Multiple apps may show different scores because over 10 active scoring models exist today.

What Is Considered a Good Credit Score?

People frequently ask what is considered a good credit score or what’s a good credit score because they want a clear target. A good credit score generally places you in a position to qualify for common loans and credit cards with reasonable interest rates.

However, “good” depends on purpose. A mortgage, car loan, and credit card all have different approval thresholds. Someone searching what is a good credit score to buy a car with no down payment needs more specific guidance than someone applying for a basic credit card.

The most important factor is consistency. Long-term habits matter far more than short-term spikes.

What Scorelive Means in Search Behavior (With Data)

Scorelive reflects high-intent search behavior. Data from digital analytics platforms shows:

- Sports score searches account for ~62% of all “score”-related queries

- Credit score searches make up ~23%

- Academic score searches ~10%

- Digital/social scores ~5%

This overlap explains why a search for Scorelive often returns mixed results. Google prioritizes freshness, authority, and relevance, so context matters. Adding a single clarifying word can improve result accuracy by up to 70%, based on SEO CTR studies.

Why Live Scores Sometimes Appear Incorrect (Data Insight)

Per sports analytics reports:

- 41% of score confusion comes from time zone differences

- 29% from postponed or rescheduled games

- 18% from preseason vs regular season mix-ups

- 12% from outdated cached pages

Adding “today,” “live,” or the league name reduces incorrect results by nearly 60%.

What Is a Credit Score? (With Real Financial Data)

A credit score is a predictive risk number used by lenders. In the U.S., over 90% of major lenders rely on credit scores to approve loans.

Credit Score Usage Stats

- 68% of Americans check their credit score at least once per year

- 52% check it before applying for a loan

- People with higher scores pay up to 40% less interest over loan lifetimes

When users search what is a credit score or what is my credit score, they are often preparing for a financial decision within the next 30 days.

What Is the Highest Credit Score?

Searches like what is the highest credit score or what’s the highest credit score reflect curiosity more than necessity. While scoring models do have maximum values, reaching the absolute top is not required to receive favorable terms.

Lenders focus on risk stability. Once you reach a strong score range, other factors such as income, employment history, and debt-to-income ratio become more important. Chasing perfection often leads to unnecessary stress. Focus on reliability instead.

How to Check Your Credit Score Safely

Many users ask how to check my credit score or how to check credit score because they fear scams. The safest options are your bank, credit card provider, or official credit reporting services.

Avoid websites that promise instant increases or demand payment upfront. Legitimate score checks do not require urgency or pressure. A good habit is to check your credit report along with your score. Errors on reports are common and correcting them can improve your score naturally.

How to Improve and Increase Your Credit Score

Searches for how to improve credit score and how to increase credit score are extremely common. The most effective strategies are simple and proven:

Pay every bill on time, keep balances low, avoid frequent new applications, and maintain long-term accounts. Even small changes create steady improvement over time. There is no safe shortcut. Real improvement is gradual but reliable.

Academic Scores: What Is a Good SAT Score?

Students often search what is a good SAT score without understanding that “good” depends on goals. Colleges evaluate scores relative to their applicant pool, not an absolute number.

Improvement matters more than perfection. Admissions teams also review coursework, essays, and extracurriculars. Scorelive searches help with general guidance, but official testing portals provide the most accurate benchmarks.

What Is a Good PSAT Score?

When students ask what is a good PSAT score, they are often thinking about preparation or scholarship eligibility. The PSAT is primarily a diagnostic tool. Its value lies in identifying strengths and weaknesses early.

Students should focus on progress rather than comparison. Section-level improvement leads to better long-term results.

How Does Snap Score Work?

The question how does Snap score work reflects curiosity about social validation. Snap score increases with activity such as sending snaps and engaging with friends. Exact formulas are not public and may change.

There are no safe hacks. Attempts to manipulate Snap score can lead to account issues. It is best viewed as a fun engagement metric, not a measure of real influence.

How to Find Z Score in Statistics

Searches like how to find z score appear frequently among students and researchers. A z-score shows how far a value is from the average, measured in standard deviations.

A z-score of zero means average. Positive values indicate above average. Negative values indicate below average. Z-scores help compare data across different scales. This type of score is analytical, not judgmental.

FAQs

What is Scorelive used for?

Scorelive is commonly used to find fast score updates. It applies to sports scores, credit scores, test scores, and digital metrics depending on context.

Why do Scorelive searches mix sports and credit results?

Because the word “score” is used across multiple fields. Adding context words improves accuracy.

Is checking my credit score harmful?

No. Checking your own credit score does not hurt it when done through legitimate platforms.

Are live sports scores always accurate?

They are accurate when sourced from official league data and updated in real time.

Does Snap score affect real-life opportunities?

No. Snap score only affects in-app engagement visibility.

Which score matters most?

The score that impacts your immediate decision sports for fans, credit for finances, academic for education.

Final Thoughts: Using Scorelive the Smart Way

Scorelive is not just about numbers it is about speed, accuracy, and decisions. From live sports scores that shift in seconds to credit scores that shape years of financial outcomes, every score carries weight. Data shows that people who understand their scores make smarter choices, avoid costly mistakes, and stay ahead. Whether tracking an NFL score, improving a credit score, analyzing test performance, or understanding digital metrics, clarity beats confusion every time. Scorelive works best when paired with context, trusted sources, and informed action. In a world driven by data, those who understand scores don’t just watch results they control outcomes.